Data analytics helps resolve problems in business units and organizations. These solutions that come up by studying big data are helpful contributions of the data scientists and data engineers working on it. Working on data analysis thus can act as a way to earn even higher profits and avoid wastage of money as a resource.

In the current scenario, every giant company has a huge amount of big data that needs applicability study by the data scientists and big data engineers. The company also requires data analysis techniques to move forward to help make better business decisions.

This study can help increase the profitability of the firm and improve sales. The presented article studies the discount percentage calculations based on big data and thereby increases the profitability of the company.

It is believed by all shop keepers that a discount offer increases the percentage of net profit. As a data scientist or a data engineer one cannot deny this as a rule or belief. But then showing the discount to the incorrect extent (say 50% discount when 29% can work and cause equal sale) could also be the leading cause of losses especially in companies dealing with thousands of sales per day.

We will further elaborate how the giant companies can come up with the right percentage of profit even when there’s a slight 1% increase or drop of the discount offer, thus impacting the net profit in millions of dollars.

Data Analytics: Predicting the unpredictableAssuming that a company offers a discount on a product, the chances for the sale of this product gets increased.

The more discount is offered, the higher are the chances of getting the product sold. But if a company offers too much discount on a product then the number of profit receives can get greatly reduced.

For instance, if the product offered a profit of 30% it might show up with a profit of just 5%. This reduction in the percentage of profit makes it essential to study as to how much discount should be best given to still enjoy a good profit margin. Thus, the percentage of profit the company gains is greatly dependent on the amount of discount it gives. This also means the percentage of discount offered is not just a number to be decided by little computation.

In reality, the amount of discount offered would need a lot of mathematical computation and data analysis of the company’s big data. This is so because despite the agreement on offering discount there must be a well-developed reason as to why an exact percentage of discount was chosen.

Here, the point is to sell the product at the right price despite giving a discount. Even a slight error in deciding the exact amount of discount to be offered can mean a significant decrease in the net profit of the company.

Thus, the percentage of discount offered needs a thorough study of the big data of the company as well as an in-depth knowledge of the current competitor’s price for the same product.

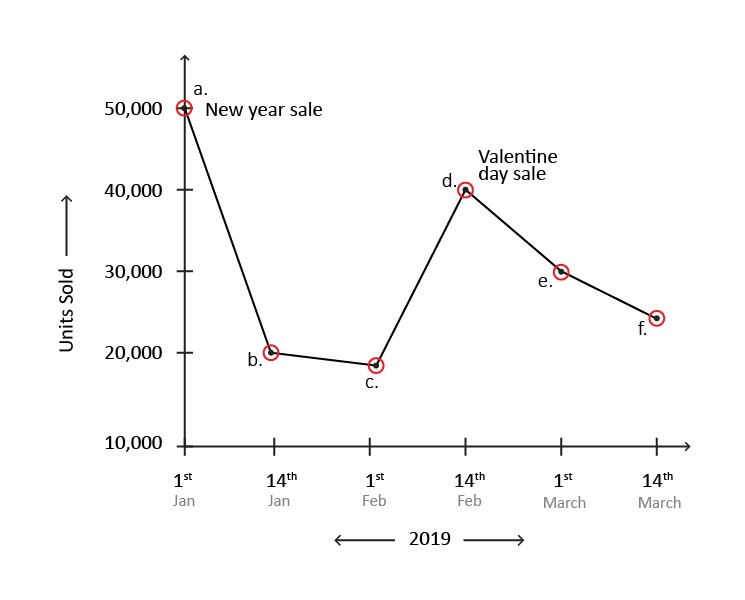

How discounts placed for a future date impacts the present sale?Take a look at this simple case study demonstrated:

- A sale of mobile phones showed up in January 2019.

- The mobile (product) sale increased by 30% in January 2019 due to the discount offered.

- In the next three months, February, March, April of 2019– the sale of mobile phones decreased by 10%.

- This means the 30% increase in sales due to the discount offered in January resulted in a lesser sale in the following 3 months of the same year.

- If there was no discount the business entity selling mobiles would have gained much more money because of selling at the original price.

Figure 1: Changes in the number of sale units based on the discount offered from January to March 2019

Further explanation -

If Company ABC doesn’t give discount benefits, then, its competitors will sell more and there can be a high probability of losses for it.

If the Company is not ABC but like Apple (Mobiles) – then the competitors do not exist in many cases for those who are brand fans. Thus, in case of lesser competition, discount offers though increases the sale in one month can also be the cause of losses in the next three months. These details can be known by creating a graph with the number of units sold on the Y-axis and date details on the X-axis.

This can be thought of as presenting the loss in net profit due to the huge discount offers on a certain date. Thus, reduces the % profit before the high discount day.

This will then help spread the discount and cause a uniform sale. Thus, reducing the requirement of website bandwidth, Number of customer care people on the peak day - a way reducing sale cost.

If you need 10,000 customer care personnel on high discount offering days, then on other 11 months of the year the company just needs 100 people (maybe) in customer care. Thus, hiring 10,000 is an over-expenditure and loss of profit.

SolutionThe data scientist needs to suggest the marketing team run advertisements throughout the year stating there’s always a good amount of sales.

This will spread the sale throughout the year and result in overall more profit in the long run.

Data analysis: Reduction in % of total profit due to discount offersAs it is essential to have profited so it is important to make the maximum possible profit. Thus, having the cost of a commodity at the right price and selling it at the correct price need not always be the highest price for causing sale or lowest price for causing sale.

For instance, Company ABC has a monopoly in books.

The books are not read by the newspaper sellers and others alike, thus, the price of the book can be optimized such that the price is lower than the market price but need not be as low as say USD 1.

It is being meant here that if the price is lowered then to what extent should it be decreased so that it continues to cause a good sale but need not drastically impact the percentage of net profit.

SolutionHere it is essential to note that a decrease in price beyond the required or expected level means a reduction in the percentage of net profit.

The objective is not to just give a discount but to reason out in detail why the exact percent of discount offered was reasonable and optimum for sale.

The article doesn’t disagree that the discount offers (say 30% and not 29%) help to increase sales and help achieve good profits.

But as a data scientist one would want to explore data on what exact percentage of discount can result in a maximum sale and maximum profit as well.

The strategies followed by Company ABC can be correct. But they will be more correct if applied in-depth or with a more detailed study. Thus, the exact and optimum percentage of discount can be figured out.

For example, if an ‘old’ book is selling more by giving a 70% discount it doesn’t mean that the selling of the same ‘new’ book at an increased discount will cause an increase in its sale. The buyers of new books especially when an old book is available can bear the cost of a new book even without much discount.

The speech of big data causing the increase in profitsA computer program can take the detailed price options from all the sites of competitors. This program will inform the company ABC at what minimum price a product is being sold today (just now) at a competitor's site.

Only the genuine sites here can be the competitor of company ABC. But if competitors play rough and decrease their rate just to increase the trouble of ABC then it is a rough game with no authentic prove and a site doing so can be rejected as a competitor and thus it is no real competitor anymore.

ConclusionA detailed study on why a particular percentage of discount was preferred over a different percentage of discount, say for example, why 30% discount was preferred over 29% is essential to cause maximum possible profit.